GST Registration Online Form 2020 | How to Get GST Registration for Business Online | gst.gov.in online GST registration | New GST Registration

The businesses having turnover/sales over Rs.40 Lakh (Rs.20 lakh in some cases mainly North East and Hill States) must register their business under GST. You can get your business GST registration very easily with online form 2020. Central Board of Direct Taxes (CBIC) has arranged the “GST Registration Online Form 2020” on the official website of gst.gov.in.

The online GST Registration procedure is very simple. We will provide you with the complete information for GST Registration Online Form 2020. Registration under GST is not tax specific which means that there is a single registration for all the taxes i.e. CGST, SGST/UTGST, IGST and cesses.

Updates: Now, you can authenticate your business with Aadhaar authentication services. GST Portal has started this service that the taxpayer can register themselves with Aadhaar authentication to get fast registration within 3 days.

Time Takes to Get GST Registration

- You should register your business within 30 days from the date when liability arises to register.

- The casual dealers need to apply at least five days prior to the commencement of the business.

- The Proper Officer has to either raise a query or approve the grant of registration within three working days failing which registration would be considered as deemed to have been approved.

- The applicant would have to respond within seven working days starting from the fourth day of filing the original application.

- The proper officer would have to grant or reject the application for registration within seven working days thereafter.

Simple Terms of GST

| Short Form | Full Form |

| CGST | Central Goods and Service Tax |

| SGST | State Goods and Service Tax |

| UTGST | Union Territory Goods and Service Tax |

| IGST | Integrated Goods and Service Tax |

Important Links

| Particulars | Links |

| Official Website | Click Here |

| GST New Registration Online Form | Click Here |

| GST Track Application Status | Click Here |

| Search GST Registered Dealer by GST Number | Click Here |

| Search GST Registered Dealer by PAN | Click Here |

| Search Composition Dealer | Click Here |

| Documents Required for New GST Registration | Click Here |

GST Registration Fee

There is no fee to get your business registered under GST. You don’t need to pay any government fee for GST online application Form. It is totally free. But if you get the service of any GST professionals like Lawyers, Chartered Accountants, GST Suvidha Centers, GST Experts then you need to pay the fee for their service.

GST Registration Limit

Old GST Registration Limit

| Aggregate Turnover | Registration Required or Not | Applicability Date |

| Over Rs.20 lakh | Yes (Normal Category States) | Up to 31-03-2019 |

| Over Rs.10 Lakh | Yes (Special Category States) | Up to 31-03-2019 |

New GST Registration Limit

| Aggregate Turnover | Registration Required or Not | Applicability Date |

| Over Rs.40 lakh | Yes (Normal Category States) | From 1st April 2019 |

| Over Rs.20 Lakh | Yes (Special Category States) | From 1st April 2019 |

| For Composition Scheme (Rs. 1.5 Crores) (Rs.75 Lakh for North Eastern States & Uttarakhand) | From 1st April 2019 | |

| Composition Scheme for Service Providers (Rs.50 Lakh Limit) (Fixed tax Rate of 6%) | From 1st April 2019 |

Normal Category States (Over Rs.40 Lakh Registration)

Chhattisgarh, Jharkhand, Delhi, Bihar, Maharashtra, Andhra Pradesh, Gujarat, Haryana, Goa, Punjab, Uttar Pradesh, J&K, Assam, Himachal Pradesh, Karnataka, Madhya Pradesh, Odisha, Rajasthan, Tamil Nadu, West Bengal

Notes:

- Kerala and Telangana Opted for Status Quo

- J&K and Assam also opted for Rs. 40 Lakh Registration

Special Category States (Over Rs.20 Lakh Registration)

Puducherry, Meghalaya, Mizoram, Tripura, Manipur, Sikkim, Nagaland, Arunachal Pradesh, Uttarakhand

GST Registration Types

- Normal Taxpayer

- Composition Dealer

- Casual Taxable Person

- Input Service Distributor (ISD)

- Non-Resident Taxable Person

- Non-Resident Online Services Providers

- UN Body/Embassy/Other Notified Person

- Special Economic Zone (SEZ) Developer/ Special Economic Zone (SEZ) Unit

- Tax Deductor at Source (TDS)/ Tax Collected at Source (TCS)

Filing GST Registration Online Application Form 2020?

Here is the step-by-step procedure to fill the GST Registration online application form. The procedure is very simple just following the following steps.

Step 1: Visit https://www.gst.gov.in/. Click Here

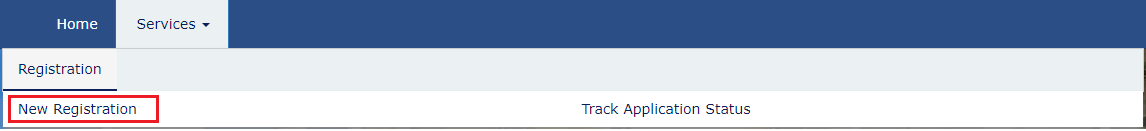

Step 2: Then go to Service > Registration > New Registration. Click Here

Step 3: Now click on “New Registration”.

Step 4: Now, you will get “Part-A” which has basic information. Now you need to fill your category, State, District, Legal Name, PAN, Email Address and Mobile Number.

Step 4: Now, you will get “Part-A” which has basic information. Now you need to fill your category, State, District, Legal Name, PAN, Email Address and Mobile Number.

Step 5: Now, enter OTP and click on “Proceed”.

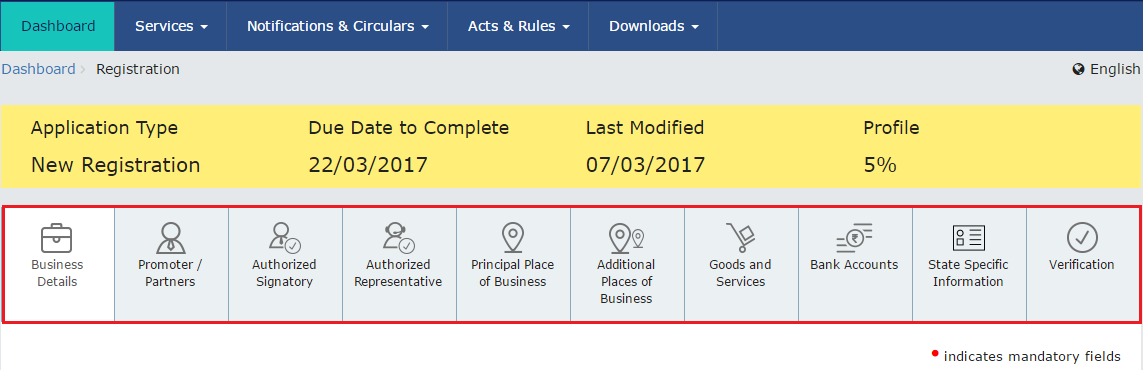

Step 6: You will get various tabs like Business Details, Promoters/Partners, AR, Principal of Business, Additional Places of Business, Goods and Services, Bank Accounts, State Specific Information and Verification.

Step 6: You will get various tabs like Business Details, Promoters/Partners, AR, Principal of Business, Additional Places of Business, Goods and Services, Bank Accounts, State Specific Information and Verification.

Step 7: Fill all the information step by step as “GST registration online application form” asking.

Step 8: After filling all the information you will get OTP on your registered mobile while clicking on “Submit With E-Signature”. Now enter OTP and validate it. All steps have now completed. Now, you will get intimation from your concerned officers.

Benefits of GST Registration

There are lots of benefits for businesses to get GST registration as follows.

- You can collect tax from customers legally and pass on the credit of taxes to your buyers..

- You can supply goods interstate without any barrier.

- You can claim an input tax credit of taxes paid by you and utilize it before making GST payments.

What to Do if Business has Multiple Branches?

GST Registration in Case of Multiple Branches with-in State

- Only 1 GSTIN Required

GST Registration in Case of Multiple Branches in the Multiple States

- Required 1 GSTIN per State

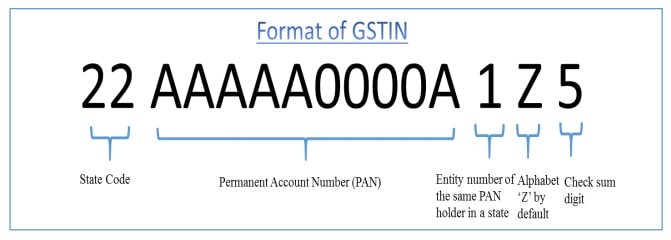

- Structure of GST Number

- The first 2 digits of the GSTIN is the State code.

- Next 10 digits are the PAN of the legal entity.

- The next two digits are for entity code.

- The last digit is check sum number.

Compulsory GST Registration Irrespective of turnover

Generally, the liability to register under GST arises when your turnover exceeds Rs.20 lakh (10 lakh rupees in special category States except for J & K).

However, the GST law enlists certain categories of suppliers who are required to get compulsory registration irrespective of their turnover. The following are the categories who must register under GST irrespective of their turnover limit.

- Inter-state suppliers; However, persons making inter-state supplies of taxable services and having an aggregate turnover, to be computed on all India.

- A person receiving supplies on which tax is payable by the recipient on the reverse-charge basis.

- A casual taxable person who is not having a fixed place of business in the State or Union Territory from where he wants to make the supply.

- Non-resident taxable persons who are not having a fixed place of business in India.

- A person who supplies on behalf of some other taxable person (i.e. an Agent of some Principal)

- E-commerce operators, who provide a platform to the suppliers to make supply through it.

- Suppliers of goods who supply through such e-commerce operator who are liable to collect tax at source. Persons supplying services through e-commerce operators need not take compulsory registration and are entitled to avail the threshold exemption of Rs. 20 Lakh

- TDS Deductors

- Input Service Distributors

- Those supplying online information and database access or retrieval services from outside India to a non-registered person in India.

- GST Registration Forms