Here is the complete information to check PAN Card status online. You can get here the complete official links where you can check new PAN card application status online. You can also get the information about new PAN card application procedure, PAN correction procedure, PAN reprint procedure, PAN application fees, transaction status, PAN Form 49A online.

Very Important: Is your PAN card linked with Aadhaar card? Link Your PAN Card Here

![]() Update on 2nd September 2020: Banks can now access IT return filing status of PAN holders

Update on 2nd September 2020: Banks can now access IT return filing status of PAN holders

![]() Did You Know: Now, you can get e-PAN card within a minute online. No need to wait for 7 days. Check here for detail

Did You Know: Now, you can get e-PAN card within a minute online. No need to wait for 7 days. Check here for detail

![]() Updates: Having any query about PAN Card Status, you can ask NSDL on twitter through this link https://twitter.com/NSDLeGovernance

Updates: Having any query about PAN Card Status, you can ask NSDL on twitter through this link https://twitter.com/NSDLeGovernance

UTI NSDL/TIN (PAN Card Services)

PAN Card Status | Apply New PAN Card | PAN Card Correction | Re-Print PAN Card

www.GovtJobGuru.in

PAN Card Status Quick Information

New PAN card Application Fee

- Offline (Indian Citizen): 107/-

- Online Paperless (Indian Citizen): 101/-

- Offline (NRI): 1017/-

- Online Paperless (NRI): 1011/-

Important Documents Required

- Aadhar Card

- Voter Card

- Driving License

- Passport

How to Apply PAN Card

There are two Govt agencies/online portals where you can apply PAN online or offline.

- NSDL

- UTI

Then there are three methods by which you can apply PAN.

- Offline Method: PAN Application submitted at TIN Centres/PAN Centres (Form 49A with attached documents) –

- Semi Online Method: PAN Application submitted online (Form 49A Online, Documents Offline to address of NSDL)

- Purely Online Method: PAN Application submitted online through paperless modes (e-Sign by Aadhar, e-Sign scanned based, DSC scanned based)

Offline Method – Steps for PAN Application Submitted at TIN Centres/PAN Centres

- Download Form 49A

- Fill the 49A after reading all the instructions. You can find the instructions links under the heading of important links.

- Attached photograph and documents.

- Submit the PAN Card form 49A with all required documents to the TIN Centres. You can check TIN Centres location near you here.

Semi Online or Online Method – Steps PAN Application Submitted Online

1) Visit the PAN card apply online link https://www.tin-nsdl.com/services/pan/pan-index.html

2) After filing the basic information, you need to select the four option for documents verification.

- Submission of physical form and documents after online data entry

- Aadhar based e-KYC

- Scanned based- Aadhar based e-Sign

- Scanned based – Digital signature certificate (DSC)

3) After selecting the option make payment as per application payment fee given above.

That’s it.

How to Check PAN Card Status Online?

- After submitting of new PAN application, you need to wait for PAN card allotment.

- It takes 2 weeks by Income Tax Department to dispatch new PAN Card. You can check your PAN card status by the following links.

- It is very simple to check PAN card status.

- Enter acknowledgement Number/Coupon Number and Date of Birth.

- You will get your PAN Card status within seconds.

- You can also get e-PAN card printout. The links to get print out of e-PAN card are given below.

UTI PAN Card Important Links

| Particulars | Links |

| UTI New PAN Card Registration Online | Click Here |

| Regenerate Online PAN Application Online | Click Here |

| Download Form 49A (To Apply PAN Card Offline) | Click Here |

| Track PAN Card Status | Click Here |

| Changes or Correction in PAN Card | Click Here |

| Download e-PAN | Click Here |

| Reprint PAN Card | Click Here |

| PAN Bulk Verification | Click Here |

| Address Update in PAN through eKYC Mode | Click Here |

| UTI PAN Card Application FAQ (General) | Click Here |

| Format of e-PAN | Click Here |

| Designated PAN Centres for Biometric Aadhaar | Click Here |

| List of Documents to Apply New PAN | Click Here |

| UTI Main Official Address and Locations | Click Here |

| Instant PAN through Aadhaar |

Click Here |

NSDL PAN Important Links

| Particulars | Links |

| Apply New PAN (NSDL) Online | Click Here |

| Know Status of PAN Application | Click Here |

| Reprint of PAN Card | Click Here |

| Download e-PAN Card (Allotted in last 30 days) | Click Here |

| Download e-PAN Card (Allotted more than 30 days) | Click Here |

| Update Address in PAN | Click Here |

| Instant PAN through Aadhaar |

Click Here |

PAN Card Status Detail Information

Application Fee for New PAN Card

This sections not related to PAN card status. It is only to provide you the complete PAN application fee detail.

The table includes both Indian citizens and Non-Resident Citizens.

1) When Physical PAN Card is Required

a) When PAN application submitted at TIN Facilitation Centres/PAN Centres

| Particulars | NSDL Fee | UTI Fee |

| Dispatch of Physical PAN Card in India | 107 | 107 |

| Dispatch of physical PAN Card outside India (Where foreign address is provided as address for communication) | 1017 | 1017 |

b) When PAN application submitted online using physical mode (i.e. Physical documents forwarded to NSDL e-Gov)

| Particulars | NSDL Fee |

UTI Fee |

| Dispatch of Physical PAN Card in India | 107 | 107 |

| Dispatch of physical PAN Card outside India (Where foreign address is provided as address for communication) | 1017 | 1017 |

c) When PAN applications submitted online through paperless modes i.e. e-sign or DSC scanned

| Particulars | NSDL Fee |

UTI Fee |

| Dispatch of Physical PAN Card in India | 101 | 101 |

| Dispatch of physical PAN Card outside India (Where foreign address is provided as address for communication) | 1011 | 1011 |

d) Reprint of PAN Card

| Particulars | NSDL Fee |

| Dispatch of Physical PAN Card in India | 50 |

| Dispatch of physical PAN Card outside India (Where foreign address is provided as address for communication) | 959 |

2. When Physical Card is not Required

a) PAN application submitted through TIN Facilitation Centres/PAN centres

| Particulars | NSDL Fee |

UTI Fee |

| e-PAN Card will be dispatched at the email ID mentioned in the PAN application form | 72 |

72 |

b) When PAN application submitted online using physical mode (i.e. Physical documents forwarded to NSDL e-Gov)

| Particulars | NSDL Fee |

UTI Fee |

| e-PAN Card will be dispatched at the email ID mentioned in the PAN application form | 72 | 72 |

c) PAN applications submitted Online through paperless modes ( e-KYC & e-Sign / e-Sign scanned based / DSC scanned based):

| Particulars | NSDL Fee |

UTI Fee |

| e-PAN Card will be dispatched at the email ID mentioned in the PAN application form | 66 | 72 |

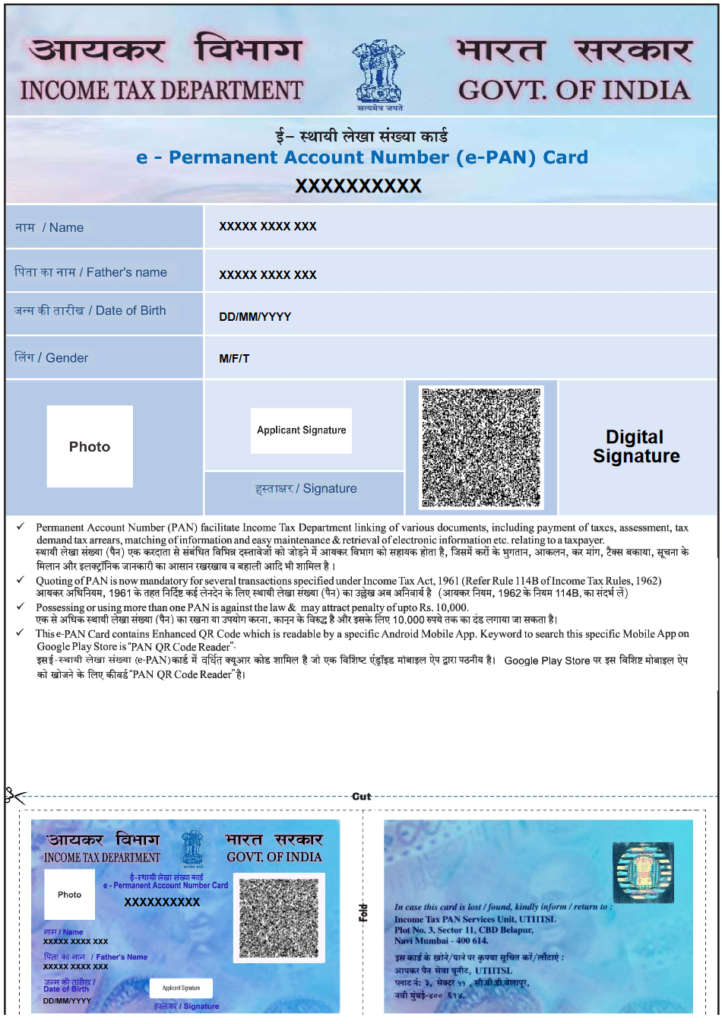

Format of e- PAN

PAN cards are now being printed with Enhanced Quick Response (QR) Code.

After getting the PAN card status, you can wait to get physical PAN card or you can also get print out of e-PAN card. It is valid as same of physical PAN card.

Features of new PAN Card design:

- Enhanced QR Code will contain Photograph & Signature of PAN applicant apart from existing information i.e., PAN, Name, Father’s Name/Mother’s Name, Date of Birth/Incorporation/Formation. The aforesaid details will be digitally signed & coded on the Enhanced QR Code.

- Enhanced QR Code shall be readable by specific Mobile App which is available on Google Play Store (Key words – ‘Enhanced PAN QR Code Reader’). An auto focus camera having resolution of 12 Mega Pixel and above is recommended for reading of the Enhanced QR Code.

- Positions of Photograph, Signature, Hologram and dimension of QR Code have changed.

- The Enhanced QR code will also be provided in the e-PAN Card issued to the PAN applicants.

It is clarified that PAN cards and e–PAN Cards issued prior to July 7, 2018 in old design will also remain valid.

Latest News Related to PAN Card Status

Updated on 10-02-2019: Finance Anurag Singh Thakur had recently told the Lok Sabha that 17.58 crore PAN card holders are yet to link their PAN cards with Aadhaar cards. He said that as many as 30.75 crore PANs were linked to Aadhaar till January. The deadline to link the two documents was extended for the eighth time to March 31, 2020.

Updated on 11-12-2019: High Court declines to order linking of Facebook, Twitter, WhatsApp Accounts with Aadhaar and PAN.

Update on 07-12-2019: Be Aware of Last Date to Link PAN Card with Aadhar Card – The last date to link Aadhar with PAN card is 31st December 2019. All PAN cards that are not linked to Aadhaar as “invalid” or not in use.

Update on 04-12-2019 – PAN Card to be Issued Online Instantly Using Aadhaar: Govt will soon launch the service to issue e-PAN Card instantly only by providing Aadhar number.

Updated on 24-10-2019 – Link PAN Card with Social Media Accounts: A lawyer reached the Delhi High Court for seeking direction to the Government to link Social Media Accounts with PAN or UID to remove fake accounts.

Updated on 16-10-2019- Reprint PAN Card: Now you can reprint of your PAN card for just Rs. 50 from UTIITSL and NSDL. You just need to visit the website of NSDL or UTTISTL and select the option “Reprint the PAN Card”. You can pay fee online of Rs.50 and they will send your PAN Card at your address.

PAN card rules: Giving a wrong PAN number can lead to a ₹10,000 fine: Under Section 272B of the Income Tax Act 1961, the income tax department might impose a penalty of ₹10,000 if anyone is found to have given an incorrect PAN number. More Information